As a publisher, the way you price your ad inventory can greatly impact your revenue optimization efforts. Setting the floor price wisely is crucial to maximize your ad inventory’s potential. Here’s everything you need to know.

But Why Does Floor Price Matter?

Publishers can ensure a strong base for their ad inventory and earn significant income by setting a reasonable floor price.

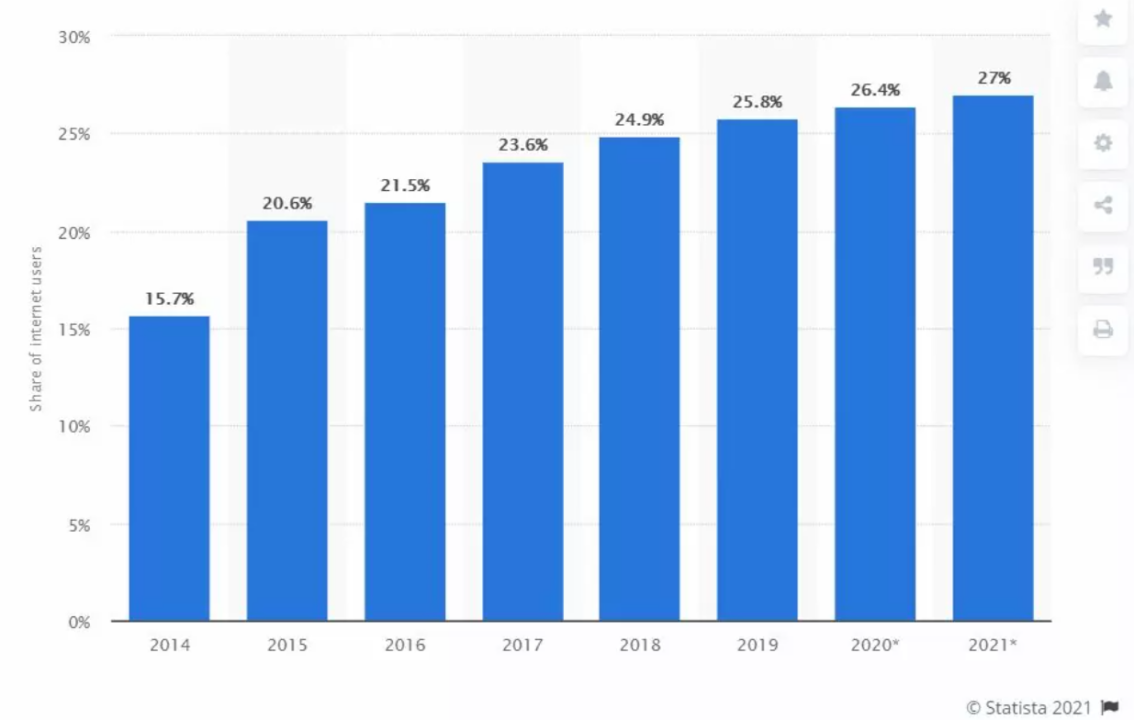

Programmatic advertising has already reached a staggering $417 billion in 2021 and is projected to reach an impressive $726 billion by 2026.

To achieve your goal as a publisher, it is important to make the most of your ad inventory and have a good understanding of the floor price.

Before we go into the details of setting the floor price, let’s first understand what it means.

What is a Floor Price?

Floor prices assure buyers participating in a programmatic auction that they will not be able to acquire an impression at a price lower than the predetermined minimum price.

For instance, if a floor price of $5 is established and bids of $4, $5, $6, and $7 are received, only the last two bids will be taken into consideration. This is due to the fact that the floor price has effectively eliminated the bids below the set price, ensuring that the auction proceeds with bids that meet or exceed the minimum price requirement.

If the bid is a little lower than the floor price, will it still count? That’s when a soft floor comes into play. This leads us to our next topic, “types of floor price.”

Types of Floor Price

Soft Floor

Soft floors are referred to as bids that are slightly lower or around the set floor price by the publisher yet still attract consideration from advertisers. Publishers often accept these soft floors, as they would rather generate some revenue than none at all.

Hard Floor

Conversely, a hard floor refers to a minimum price set by publishers, below which no bids are accepted. By adopting this strategy, publishers are able to retain full authority over the value and significance of their advertising inventory.

Dynamic Floor

By analyzing the performance of demand partners over time, dynamic floor prices adjust themselves accordingly. However, publishers should not simply set them and leave them unattended. It is crucial for publishers to regularly monitor and optimize the floor value as programmatic demand channels change. This ongoing effort ensures the highest revenue potential and a competitive advantage.

How Does Floor Price Work?

Previously, if the first ad network couldn’t meet the minimum price, the ad inventory would be handed over to another network. However, things have changed now. Publishers no longer rely on the waterfall system. Instead, they use real-time exchanges and header bidding. Networks that bid below the minimum price are rejected, and only those bidding at or above the minimum are considered.

Setting the minimum price is crucial to maximizing the earnings of publishers. However, publishers often have limited time due to their various responsibilities, such as content creation, to regularly make adjustments. Therefore, they frequently collaborate with their partners to periodically modify the minimum price, such as on a weekly or monthly basis.

Now, let us delve into the core of the issue and examine the elements that warrant consideration when determining the floor price for your advertising inventory.

What to Consider When Setting Floor Price?

To make the most of your ad space in terms of revenue, there are certain factors you should take into account while setting a floor price. Let’s have a look.

Country

Publishers often use this parameter to determine the minimum price for their ads. If you have traffic from the US, it is recommended to set higher floor prices for the inventory, where advertisers are willing to pay more.

Device

Consider a pizza brand as an example. If you are near a local pizza shop and they can track your location through your mobile device, it is likely that they will be willing to pay more for advertising on mobile devices. On the other hand, if you are a B2B company and it is unlikely that someone will make a direct purchase of your product through mobile, the cost for advertising on desktops may be higher.

Day Parting

Retailers usually choose to spend money only when their store is open. If your inventory is suitable for these stores, it is a good idea to raise prices during opening hours and lower them after closing time.

Seasonality

Seasonality has a significant impact on CPMs and publisher revenues. As an Indian publisher who produces content related to tax filing, you are aware that the end of Q1 is a prime period to target. During this time, advertisers are more inclined to pay higher rates.

Even if you don’t have a specialized website, you can experiment with strategies such as raising the ad floor price during Christmas. This is when advertisers are willing to pay a premium and utilize their budgets fully.

Audience

If you have a news website with separate sections for Sports and Politics, you can use these audience groups to attract different types of advertisers. When the Super Bowl is happening, it’s a good idea to increase the floor prices for ads in the sports section. On the other hand, during the US presidential elections, raising prices for ads in the Politics section will yield better outcomes.

Ad Size

Some ad unit sizes are more preferred by certain publishers due to buyer demand. If your 300×600 ad unit performs better than the square 300×250 ad unit on average, it is recommended to set higher prices for the vertical unit compared to the square one.

Final Thoughts

There is no one-size-fits-all solution when it comes to optimizing floor price. It requires constant monitoring and analysis of demand channels. Publishers are advised against making significant changes to the floor price and are encouraged to make minor adjustments periodically. These adjustments can be based on an analysis of average CPMs obtained from demand partners. If you need guidance on where to begin with optimization or have any questions, please do not hesitate to reach out to us.